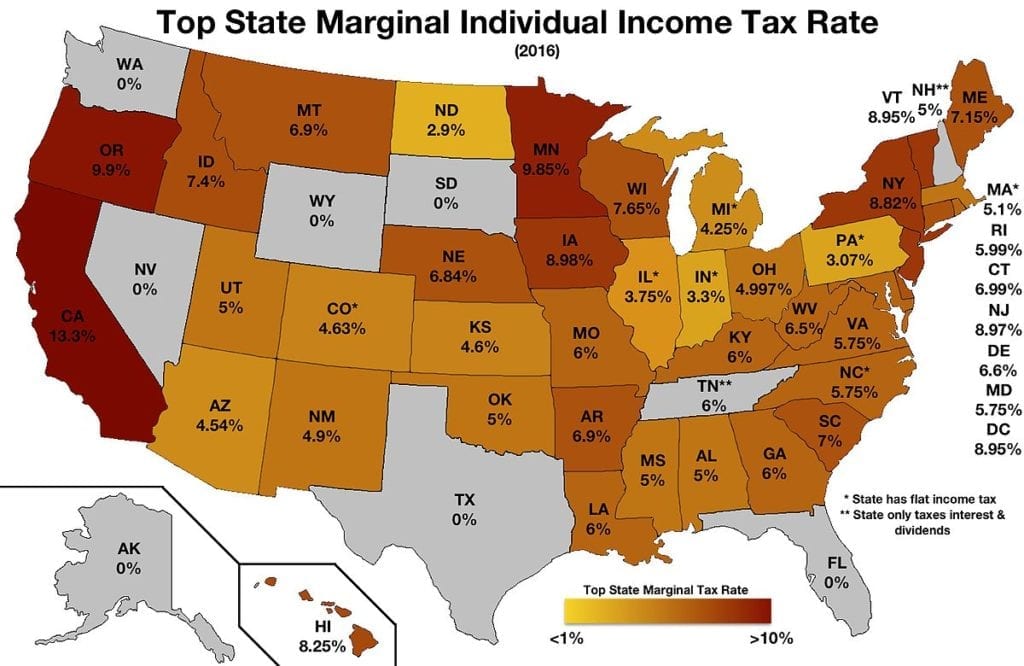

Currently, Idaho’s top marginal personal income tax is 6%.Īs Jonathan Williams and I wrote for National Review in July, several states have used budgetary surpluses to join the Flat Tax Revolution in 2022: Idaho’s four personal income tax brackets were consolidated into a flat rate of 5.8%, which goes into effect in January 2023. Last week the Idaho Legislature convened for a one-day special session and used a $2 billion surplus to give $500 million back to taxpayers through a tax rebate and provide a $150 million tax cut.

436 which lowered the top marginal personal income tax rate to 6% from 6.5% and reduced the number of brackets from five to four.īut the Gem State wasn’t finished. In February, the Idaho Legislature passed and Governor Brad Little signed H.B. It’s also the second time in 2022 that Idaho has taken on tax reform. This makes Idaho the fifth state to join the Flat Tax Revolution this year. Days ago, Idaho became the latest state to switch from a progressive personal income tax to a flat personal income tax.

If there is no record of a 1099-G in your account, you may not have received a taxable income tax refund last year.Steve Forbes’ Flat Tax Revolution is in full swing in the states. If you do not receive the 1099-G in the mail, sign up for access and log into your account through our Revenue Online service to view the amount of last year's Colorado refund that was reported to you on Form 1099-G. Taxpayers who took the standard deduction on last year's federal return generally will not report the refund on their federal return. Taxpayers who itemized their deductions using Schedule A on last year's federal return must use this information to complete their federal return this year. Contributions to any of the voluntary checkoff funds.Overpayment intercepted by the IRS or by a state agency.Overpayment applied to a prior year's balance due.Overpayment credited to the following year's estimated tax.Colorado income tax refund you received the prior year.A separate copy of your 1099-G is sent to the IRS. The IRS requires the Colorado Department of Revenue to provide Form 1099-G to taxpayers who may have itemized deductions on their federal return the previous year. The 1099-G is issued by government agencies such as the Department of Revenue and the Department of Labor and Employment for use in filling out your federal income tax return. Year-end 1099 statements are mailed in January to inform recipients about income they received during the previous year. Americans with Disabilities Act (ADA) Accommodations.

0 kommentar(er)

0 kommentar(er)